-

forex education

-

ICT SMT Divergence

-

Age 3+

-

level: Professional

-

English

Author's Instructions

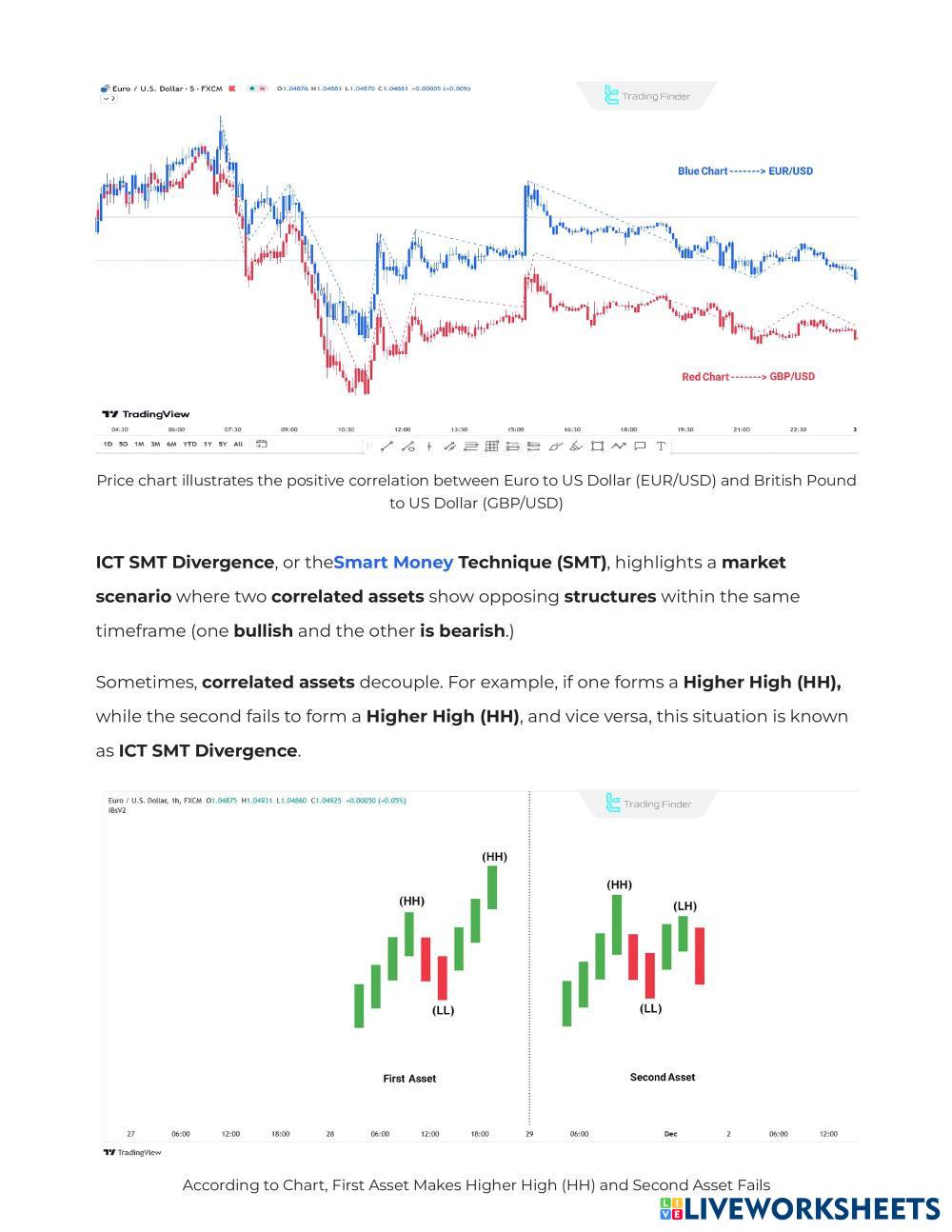

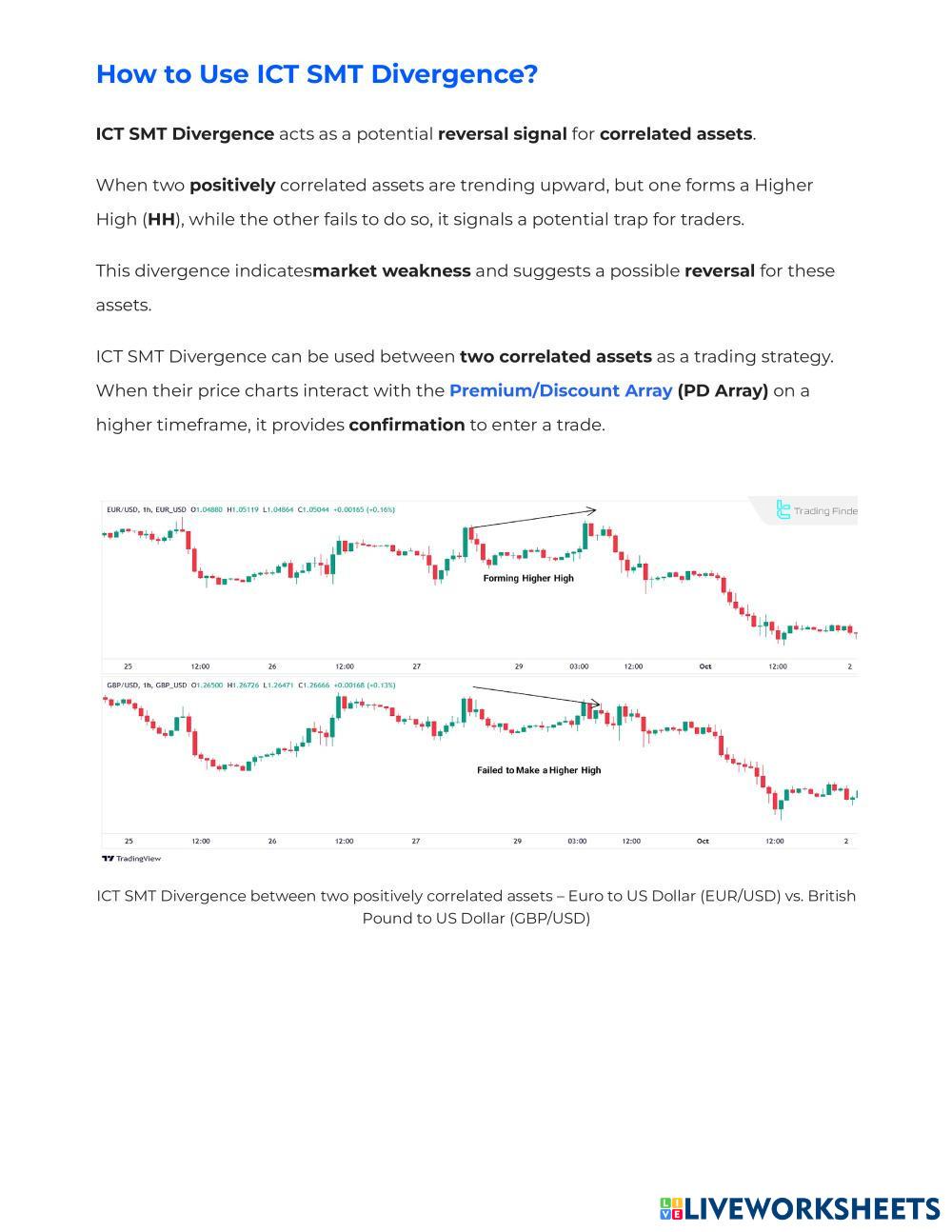

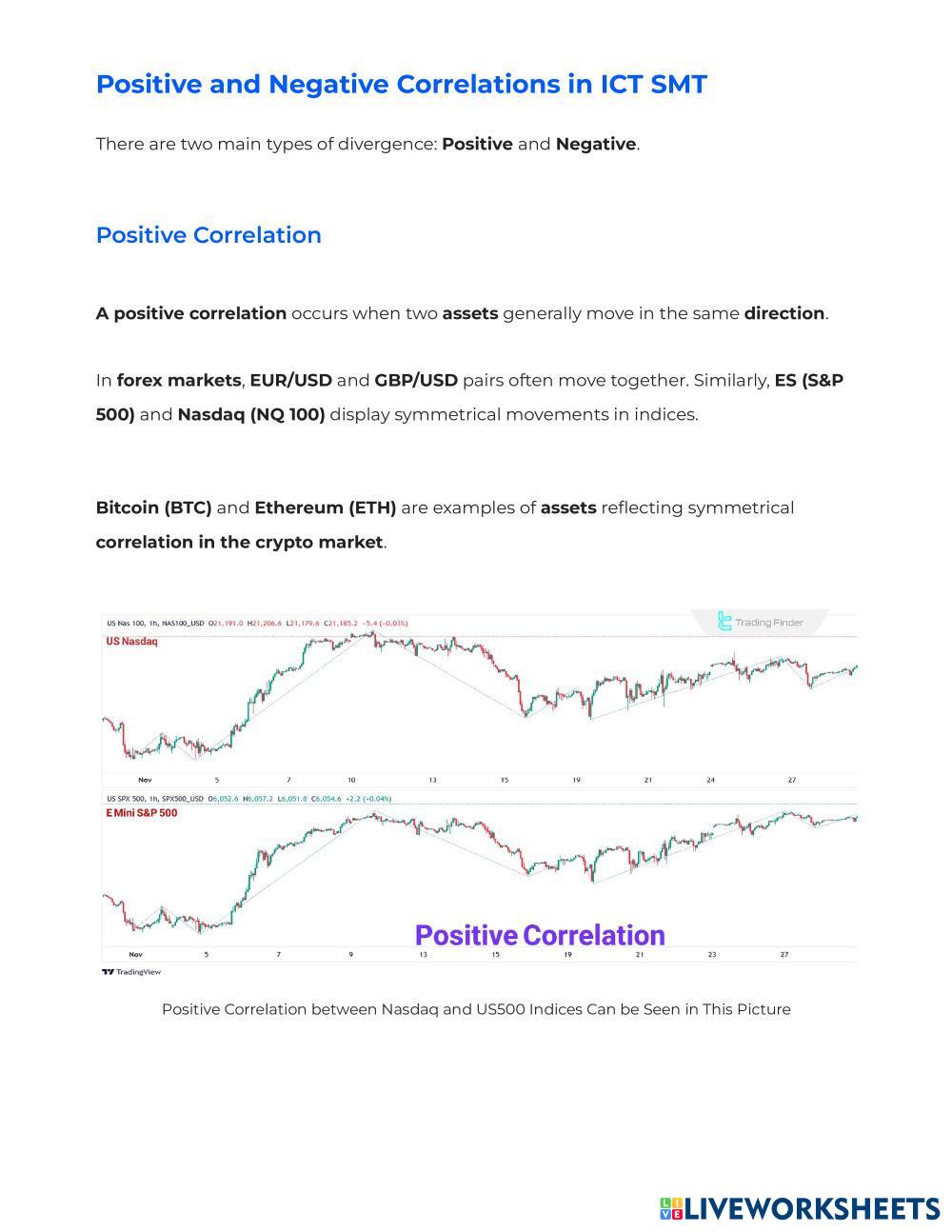

SMT Divergence occurs whentwo related and correlated assets show opposite trends [one bullish and the other bearish] on their price charts during the same timeframe in ICT style.

This situation can occur in positively correlated assets such as EUR/USD versus GBP/USD. For example, EUR/USD forms a Higher High (HH), while the other asset forms a Lower High (LH) instead of a Higher High (HH.)

In negatively correlated assets, like EUR/USD versus the US Dollar Index (USDX), EUR/USD forms a Higher Low (HL); while the other asset forms a Lower High (LH) instead of a Higher High (HH).

-

forex education

-

ICT SMT Divergence

-

Age 3+

-

level: Professional

-

English

Author's Instructions

SMT Divergence occurs whentwo related and correlated assets show opposite trends [one bullish and the other bearish] on their price charts during the same timeframe in ICT style.

This situation can occur in positively correlated assets such as EUR/USD versus GBP/USD. For example, EUR/USD forms a Higher High (HH), while the other asset forms a Lower High (LH) instead of a Higher High (HH.)

In negatively correlated assets, like EUR/USD versus the US Dollar Index (USDX), EUR/USD forms a Higher Low (HL); while the other asset forms a Lower High (LH) instead of a Higher High (HH).

📚 New Feature: Share worksheets & get automatic grading via Google Classroom 🎓

📚 New Feature: Share worksheets & get automatic grading via Google Classroom 🎓